Final Report:

U.S., Taiwan, and Semiconductors: A Critical Supply Chain Partnership

Final Report Cover – U.S., Taiwan, and Semiconductors A Critical Supply Chain Partnership

On June 21, 2023, the Project 2049 Institute and the US-Taiwan Business Council released a final joint report entitled “U.S., Taiwan, and Semiconductors: A Critical Supply Chain Partnership.” The report is the product of a project to examine vulnerabilities in the semiconductor supply chain and potential implications of supply chain disruptions, with a particular focus on Taiwan as a crucial partner for the U.S. in the semiconductor sector. The initial report under this project was published on June 8, 2022.

Executive Summary

U.S.-China trade issues, the global pandemic, and the recent chip shortages have exposed the U.S. vulnerability to supply chain disruptions. They have demonstrated the economic and national security risk that offshore vulnerabilities pose to the United States. The U.S. has attempted to reduce this dependency by incentivizing onshoring, diversifying its manufacturing base, and making key supply chains more resilient.

The risk is clear across sectors such as healthcare and pharmaceuticals, as well as in consumer goods including food, gasoline, and basic supplies. But the risk posed by a potential supply chain disruption also holds true for another significant and strategically important industry – semiconductors.

Semiconductors are the main component in all modern electronics and are therefore a critically important segment of the global economy. Any disruptions to the semiconductor supply chain would have serious repercussions for U.S. businesses and consumers by negatively impacting the economy, severely damaging the U.S. technology sector, and hampering U.S. innovation and technology leadership.

Semiconductor supply chain disruptions could also have severe repercussions for U.S. national security and U.S. critical infrastructure. Access to cutting-edge semiconductor technologies is a key driver for the weaponry that the U.S. military needs for its defensive and offensive capabilities. Currently, Taiwan and South Korea account for 100% of installed capacity to mass produce high-end semiconductors at technologies below 7 nanometers (nm), which leaves the supply to the U.S. military vulnerable. In addition, semiconductors serve as crucial components in the communications networks and transportation systems, among others, that underpin U.S. critical national infrastructure.

Countries around the world serve as key nodes in a dispersed network of suppliers for these core building blocks of the technology that modern society has come to rely upon. The U.S. works with partners around the globe, and yet the island of Taiwan may be the most critical link in the entire technology ecosystem. Integrated Device Manufacturers (IDMs), which both design and produce semiconductors, play an important role in the industry — with two of the largest such companies based in the United States. However, contract manufacturers of semiconductors (known as “foundries”) and associated companies based in Taiwan also serve as key U.S. supply chain partners. Taiwan is a significant supplier not only to leading U.S. technology firms like Apple, Texas Instruments, and Qualcomm, but also to U.S. allies globally.

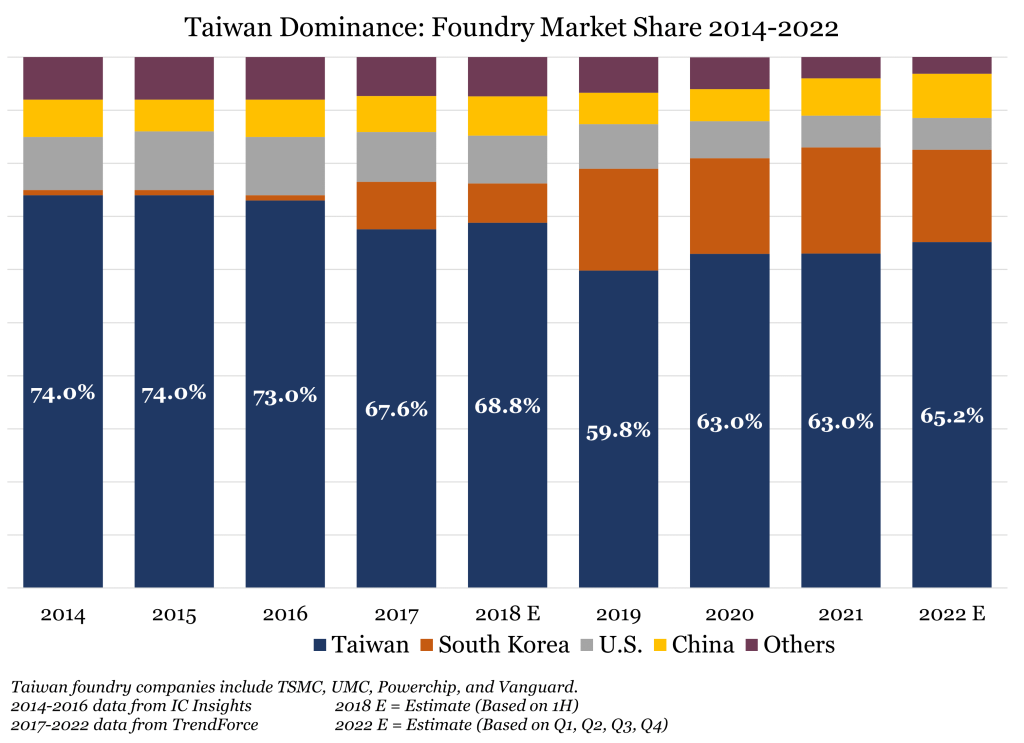

Figure 15: Taiwan Dominance — Foundry Market Share 2014-2022

The risks for disruption in the semiconductor supply chain are significant. That is true whether the source of the disruption is a natural disaster like an earthquake or typhoon, a global shock to the trading system like the COVID-19 pandemic, a disruption caused by political considerations such as a blockade or armed conflict, or by other factors. Potential risks to the semiconductor supply chain are especially acute in Taiwan, given its complex political situation and the challenges posed to it by China. Taiwan is also at risk for natural disasters, as earthquakes and typhoons are common occurrences.

There are many possible disruptions that could restrict Taiwan’s ability to fully participate in the global semiconductor industry. We classify the risks of these potential disruptions into 3 categories: 1) design risks; 2) supply risks; and 3) demand risks. The biggest design risk deals with obtaining the talent to design the next generations of chips and run semiconductor fabrication plants (fabs). Supply risks include the availability of raw wafers, processing equipment, materials, water, and power. Changes in demand, either up or down, can cause major challenges for the semiconductor industry, and the recent chip shortage is a clear example of this. Pandemics, natural or manmade disasters, and geopolitical conflicts can cause any or all the disruptions mentioned above.

The U.S. companies interviewed for this report all indicated that any significant disruption in Taiwan’s ability to participate in the global semiconductor industry would have severe negative consequences for their business. Taiwan companies expressed their real concerns about potential disruptions in power or water availability, but their biggest concern was aggressive action from China. They were confident that they could handle almost any disruption, with armed conflict the exception.

Even a small supply chain disruption involving Taiwan could have a ripple effect throughout the semiconductor ecosystem and would thereby negatively impact the U.S. economy and potentially U.S. national security. More will need to be done to encourage and strengthen the U.S. semiconductor industry position. Future investments in leading-edge technology for the U.S. market — incentivized with government funding — should help bend the curve slightly. However, it will likely take significant time and massive investments to realize a positive outcome. The CHIPS and Science Act is a good first step in supporting the U.S. semiconductor industry and will help strengthen the overall U.S. position in the crucial semiconductor sector.

Companies in the global semiconductor supply chain are already making contingency plans for the types of disruptions laid out in this report. They are determining the best course of action to build redundancy into their operations and making plans to address issues such as lack of access to water and power, even if some disruptions – such as a global pandemic or armed conflict – might be unavoidable due to their systemic nature.

Almost any action taken to make the U.S.-Taiwan semiconductor supply chain more resilient will likely be seen as a threat to China. How China reacts to that supposed threat is hard to predict. The decision made by Taiwan Semiconductor Manufacturing Company (TSMC) to build factories in the U.S. and Japan certainly is a positive step from the U.S. point of view, because it will enhance the availability of chips at high technology levels. The fact that several Taiwan material suppliers are setting up significant facilities in Arizona also helps both TSMC and U.S.-based semiconductor manufacturers.

New capacity that is currently being built outside of Taiwan could help mitigate some of the short-term or medium-term costs of any disruptions, no matter the cause. Yet the complexity of the semiconductor industry and high costs of investing in new production capacity means it would be impossible to replace Taiwan-made chips overnight. In fact, it would be nearly impossible to replace Taiwan-made chips over several years. This means Taiwan will continue to be an essential link in the semiconductor supply chain for the foreseeable future, even as new manufacturing capacity comes online in the U.S. and around the world. The United States must therefore do everything it can to ensure that Taiwan remains a close ally.

Report published by the US-Taiwan Business Council and the Project 2049 Institute

Principal Investigator is Dr. John Fowler, Non-Resident Senior Fellow for Semiconductor Research at the Project 2049 Institute. Dr. Fowler is also the Motorola Professor of Supply Chain Management in the W.P. Carey School of Business at Arizona State University.

Edited by Lotta Danielsson